Exam Code: CFE - Financial Transactions and Fraud Schemes

Exam Name: Certified Fraud Examiner - Financial Transactions and Fraud Schemes

Certification Provider: ACFE

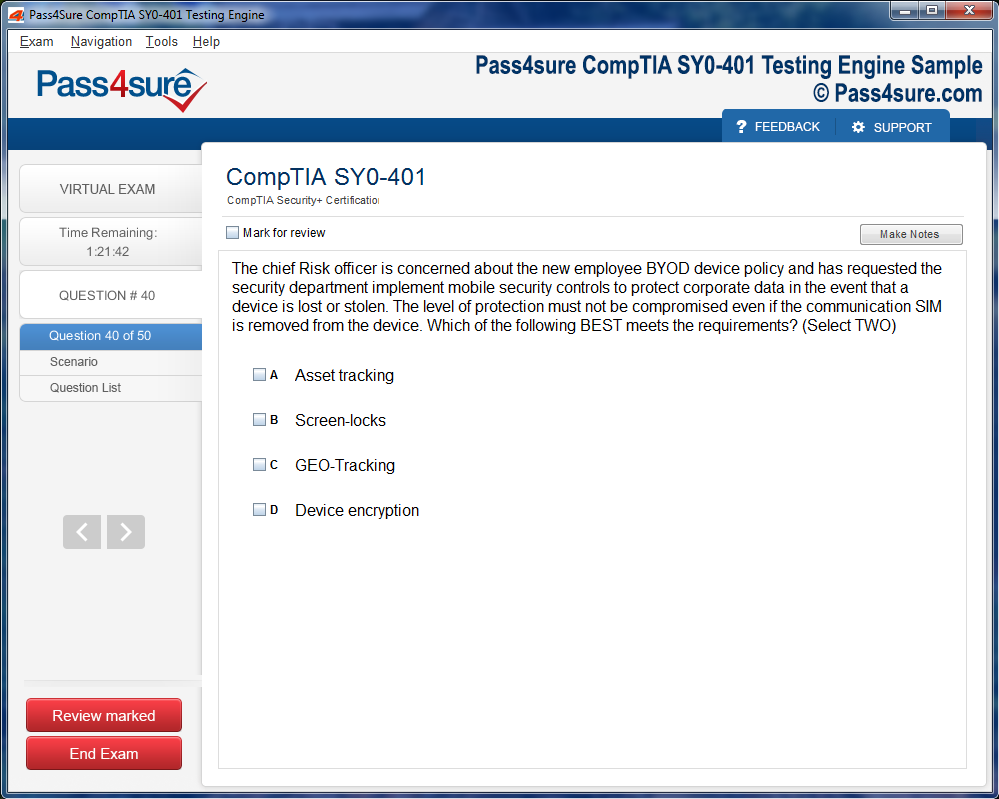

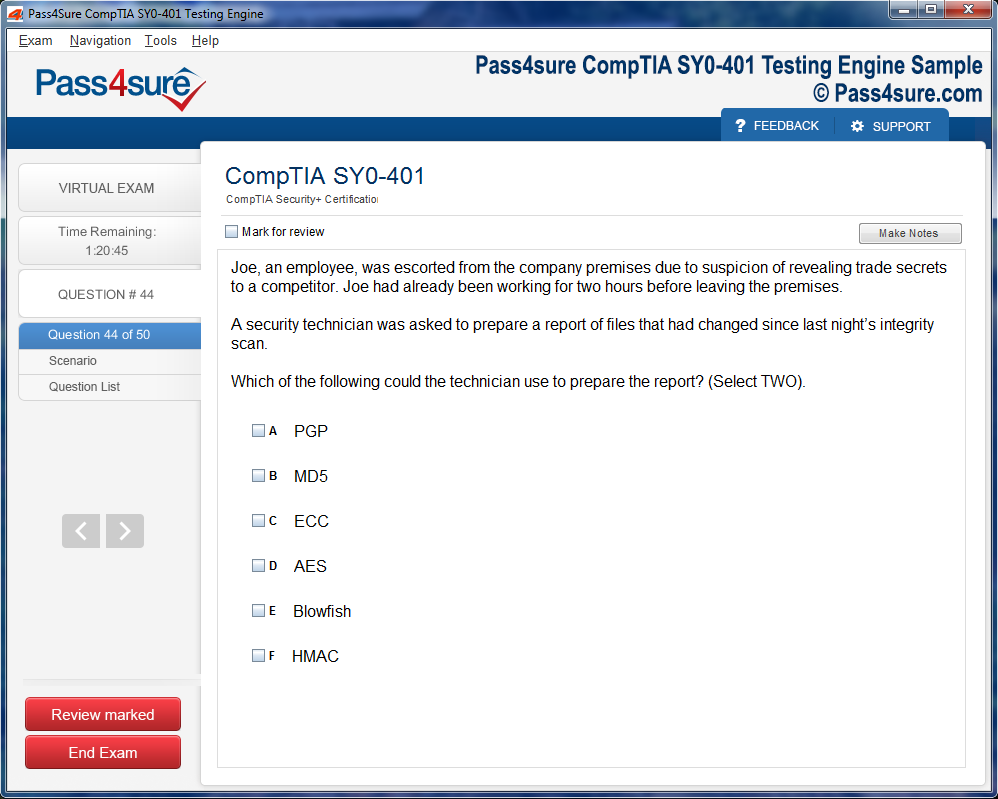

Product Screenshots

Product Reviews

Pass4sure exam engine is convenient to grasp for exam preparation

"As a matter of fact sometimes I feel that at the time of taking CFE - Financial Transactions and Fraud Schemes exam if I did not choose Pass4sure exam engine I would have been in the category of failure students. I chose Pass4sure exam engine for taking ACFE CFE - Financial Transactions and Fraud Schemes exam and passed my examination in first try. Pass4sure exam engine is not merely a exam guide it also keeps the student from each and every changes that may occurr before the examination so that students must have confidence in all respect. Pass4sure study guide keeps the students up to date, that is how students have daring attitude and feel ready for taking examination all the time.

Wallace"

My source of inspiration

"What pleased me the most was that I needed the ACFE CFE - Financial Transactions and Fraud Schemes exam helping material right away; I went to your website, found what I needed and they were here by the next day without any problems! Very pleased with the ACFE CFE - Financial Transactions and Fraud Schemes exam product I received, it has helped me learn quick and easy. Thank you for your speedy service! Pass4sure was very helpful in everything and the service was prompt. I was really pleased with the fast Service and the ability to take sample ACFE CFE - Financial Transactions and Fraud Schemes exam online. I'm really pleased about the detail of concepts. Your product helped me with taking my test.

Richard Pra"

Whiz kid Pass4sure

"Buying Pass4sure software was a good investment for me. Because of it, I passed ACFE CFE - Financial Transactions and Fraud Schemes and got excellent knowledge. As a result, my promotion became mandatory. Now, I am an active administrator due to it. Congratulations to the management for introducing such a wonderful gadget. It is really scattering the brightness in form of IT certification. Anyone can be cheer up with its help. Therefore, you can too ensure your good luck after purchasing it online.

Mike"

Pass4sure can be your success story

"Pass4sure an online site based upon getting you prepare for your certified papers is today one of the most finest and interactive site for the purpose. It only asks for 2 weeks of your time. It helps you to prepare for your certified papers in 2 weeks and what more? It guarantees to get you get pass it or else money back guarantee. I even used it to prepare for my CFE - Financial Transactions and Fraud Schemes exam and they got me fully prepared for it and I ended up achieving highest grades in the exam.

Peter"

Pass4sure's ACFE CFE - Financial Transactions and Fraud Schemes practice tests refreshed my concepts

"Hey pass4sure

I was really worried at covering the lengthy course of ACFE CFE - Financial Transactions and Fraud Schemes exam , I managed to cover somehow 4 days before the exam and for refreshing my concepts I wanted really precise and to the point ACFE CFE - Financial Transactions and Fraud Schemes practice tests. On the recommendation of my friend I bought pass4sure's Certification ACFE CFE - Financial Transactions and Fraud Schemes practice exam and with them I refreshed the entire concepts with an ease. I took my ACFE CFE - Financial Transactions and Fraud Schemes actual exam and passed it by scoring 988 marks.

I am really thankful to you for this product

Chris Minick"

Went Through A Tough Time.

"I few years before I ordered the Pass4sure Admission test products to prepare for the CFE - Financial Transactions and Fraud Schemes admission test .in length the CFE - Financial Transactions and Fraud Schemes admission test was 5 hours, and covered difficult areas of subject, they were intense. I used the They study material everyday .I work about 36 hours per week and I don't have the facility of taking off for a week before the admission test for the preparation purpose. They made me feel comfortable with the study guides, I read the PDF files and passed CFE - Financial Transactions and Fraud Schemes admission test because I was confident that they will give me success."

Find your worthy; use pass4sure!

"the only way to get instant success in CFE - Financial Transactions and Fraud Schemes is to use pass4sure ACFE CFE - Financial Transactions and Fraud Schemes guide.you will not be disappointed in any of your expected criteria.it will lead you where you want. Aehna"

Frequently Asked Questions

How does your testing engine works?

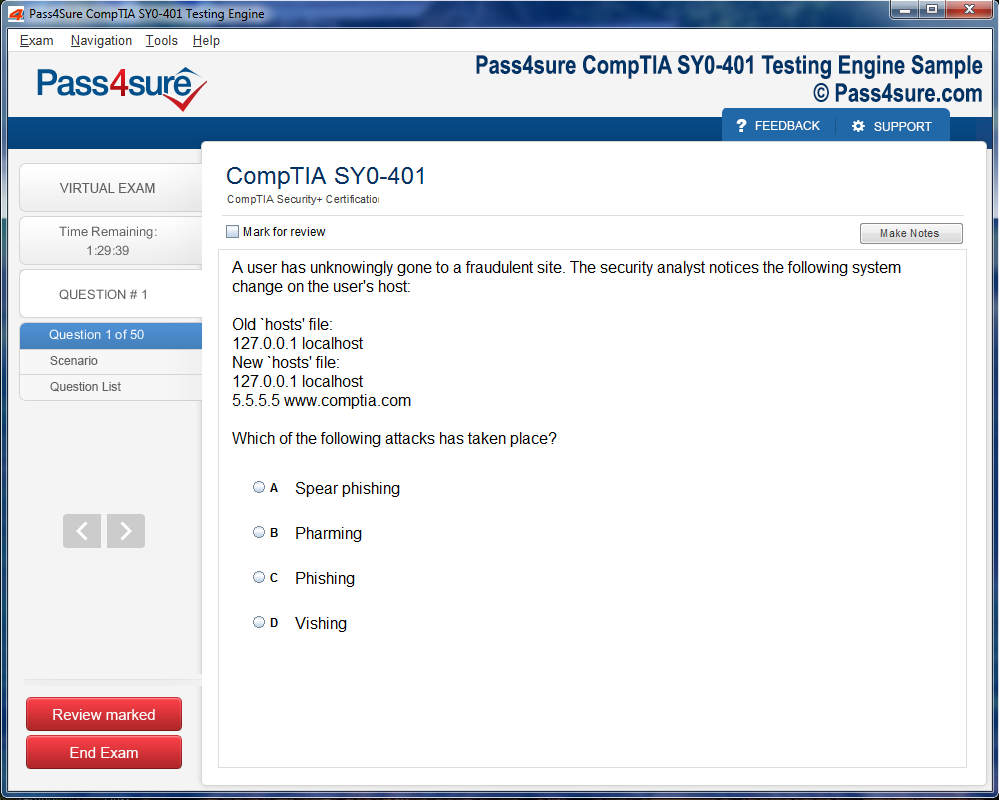

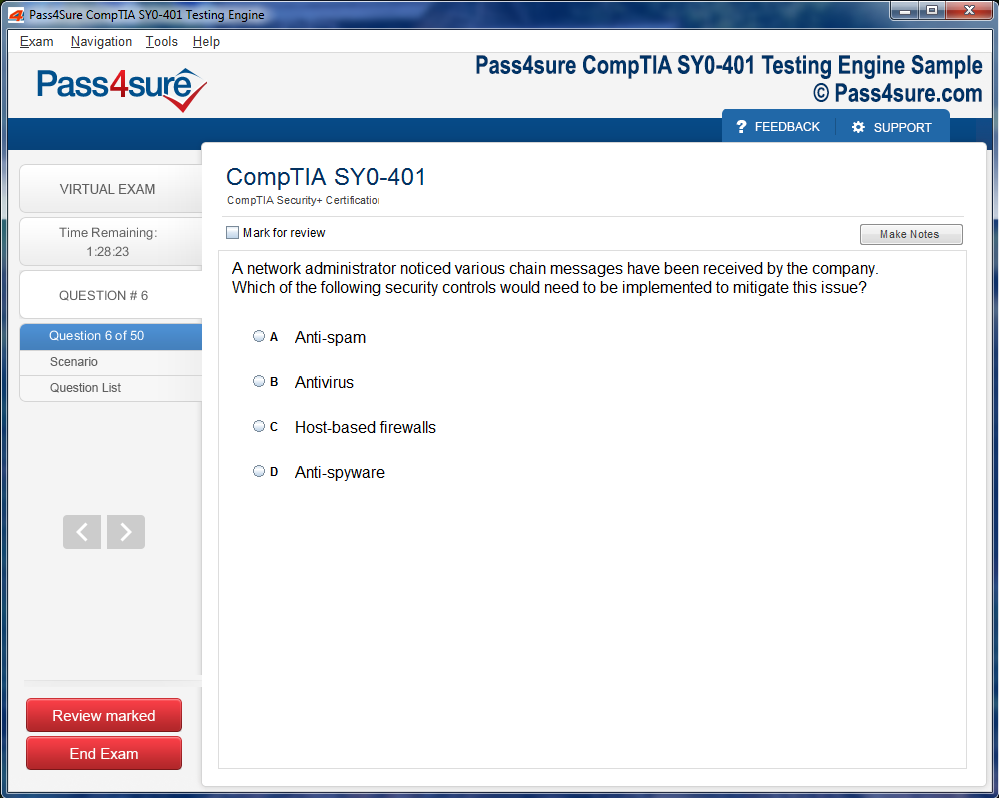

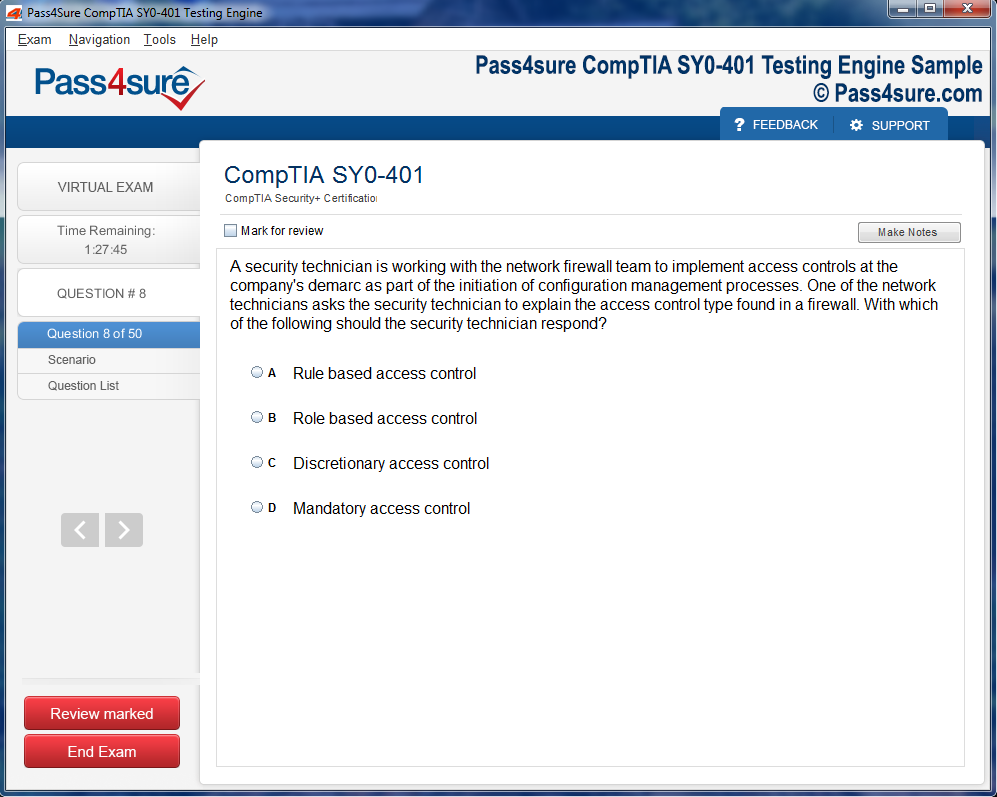

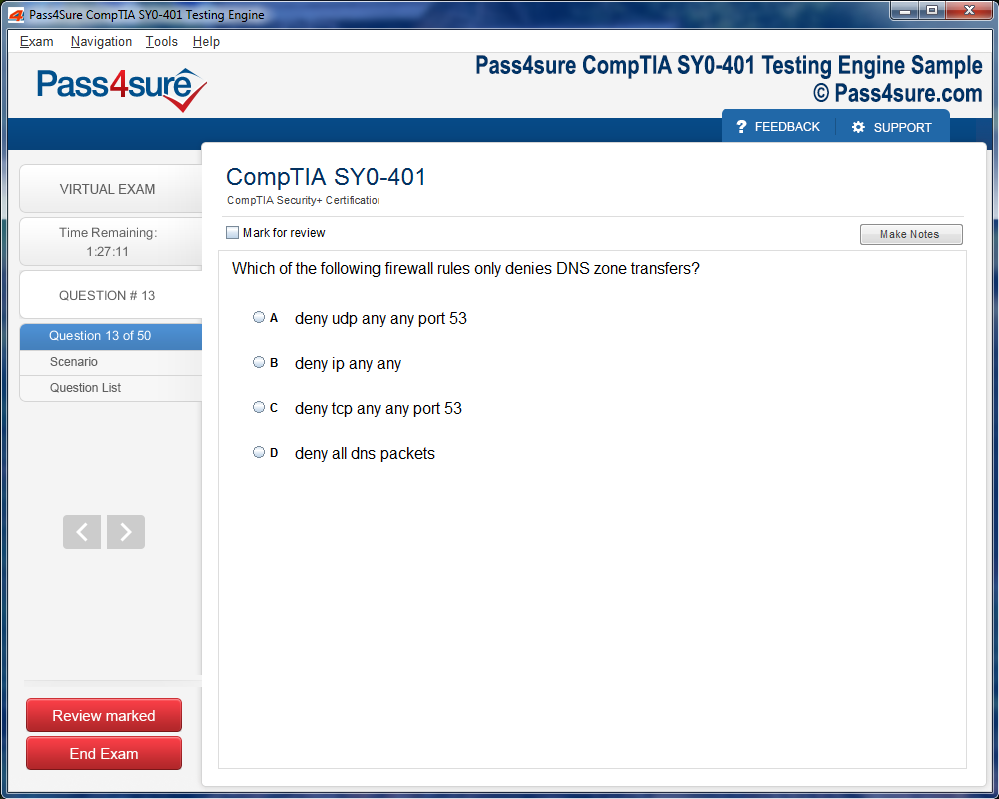

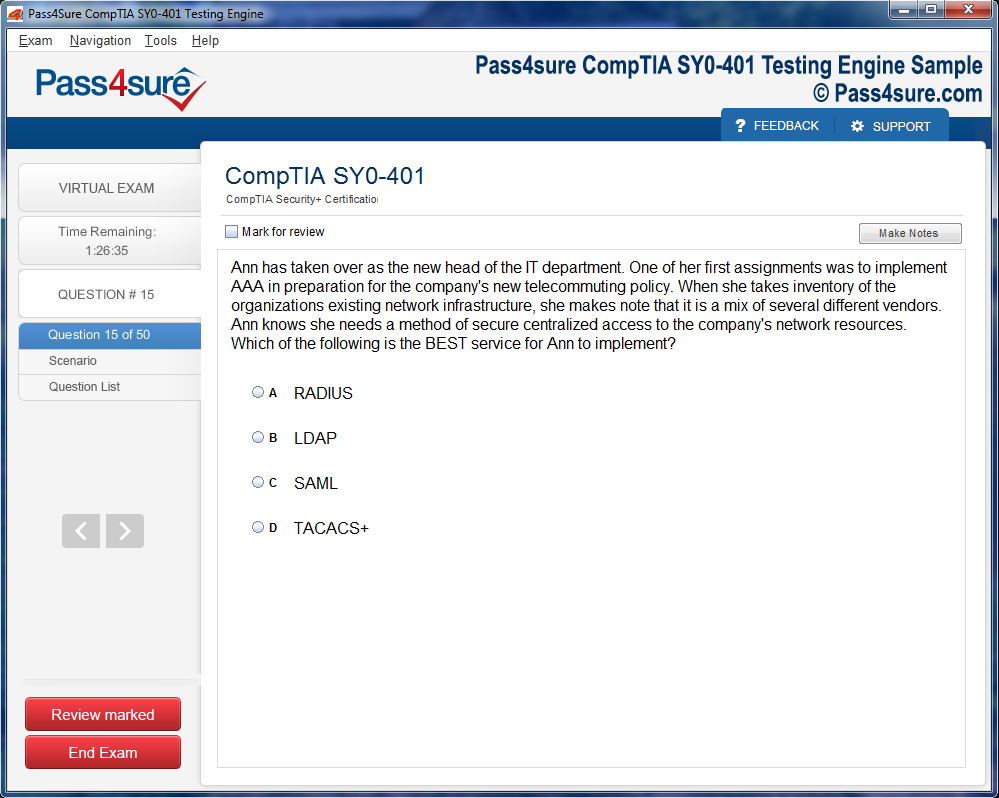

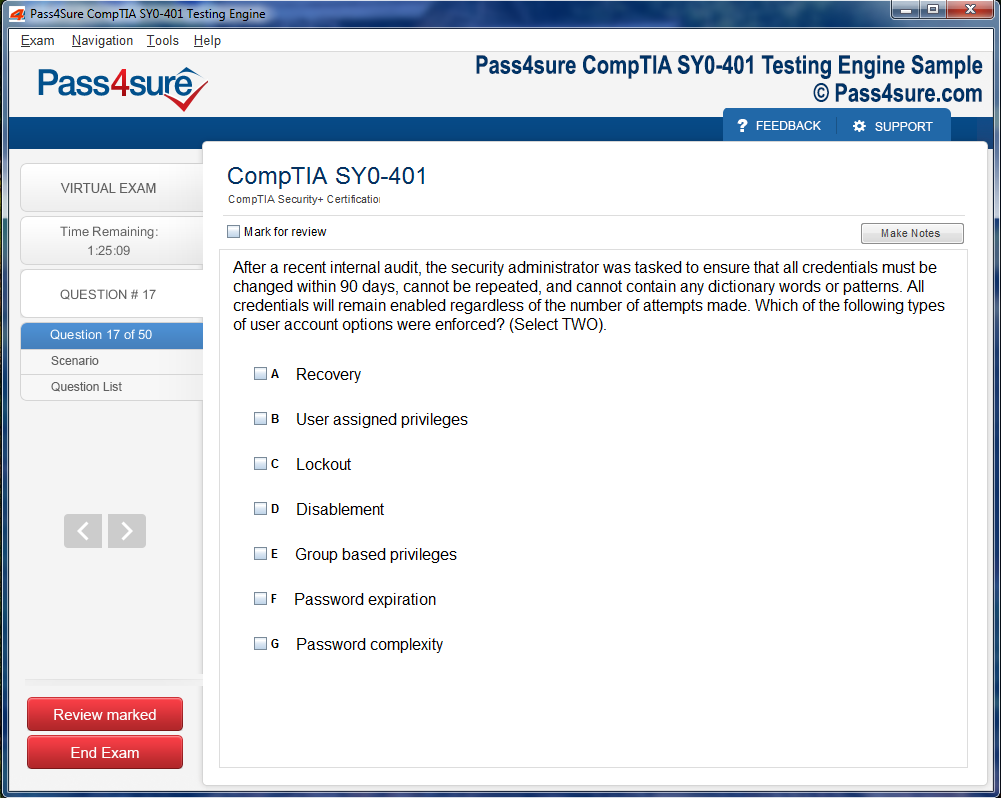

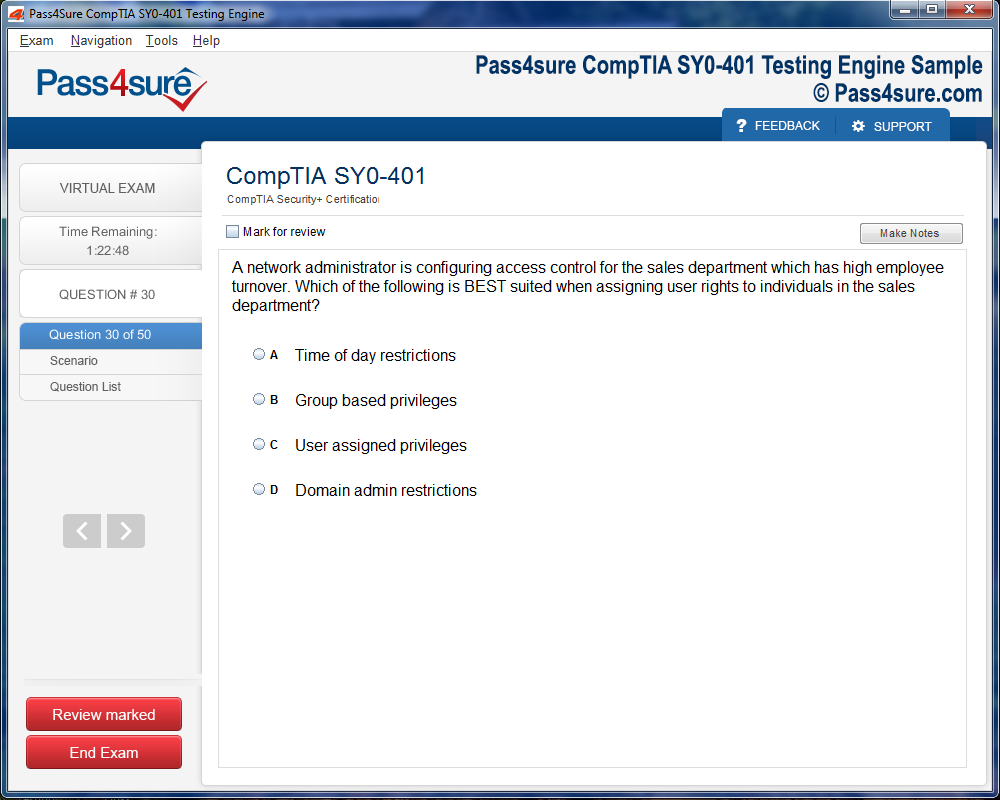

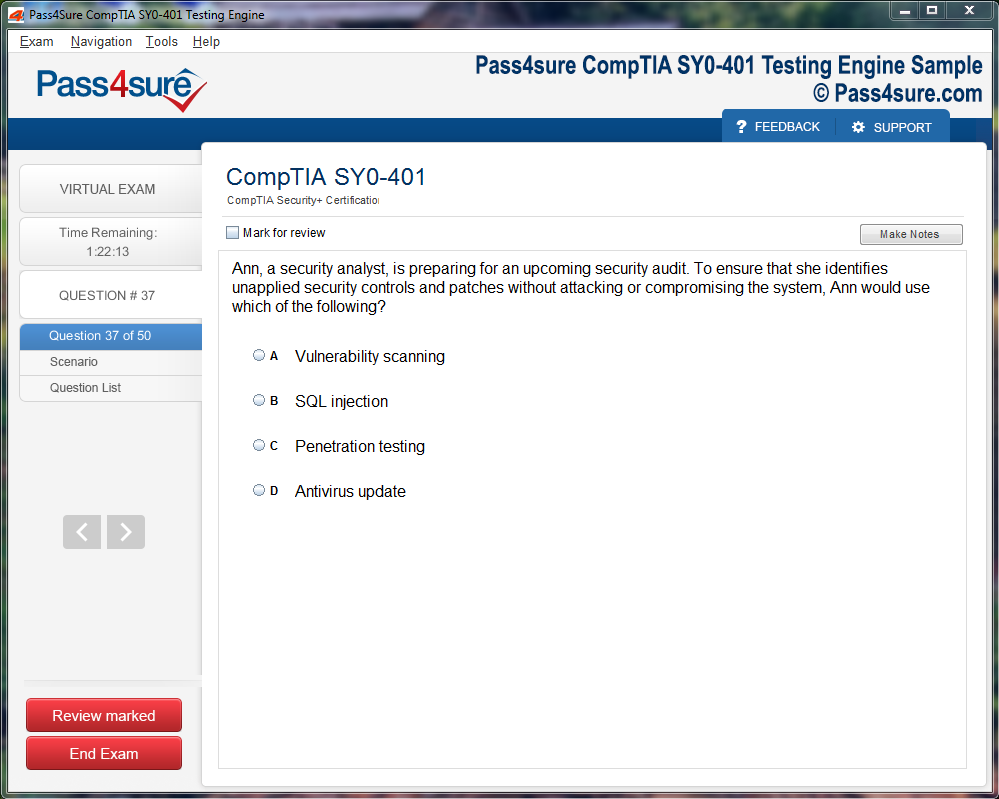

Once download and installed on your PC, you can practise test questions, review your questions & answers using two different options 'practice exam' and 'virtual exam'. Virtual Exam - test yourself with exam questions with a time limit, as if you are taking exams in the Prometric or VUE testing centre. Practice exam - review exam questions one by one, see correct answers and explanations.

How can I get the products after purchase?

All products are available for download immediately from your Member's Area. Once you have made the payment, you will be transferred to Member's Area where you can login and download the products you have purchased to your computer.

How long can I use my product? Will it be valid forever?

Pass4sure products have a validity of 90 days from the date of purchase. This means that any updates to the products, including but not limited to new questions, or updates and changes by our editing team, will be automatically downloaded on to computer to make sure that you get latest exam prep materials during those 90 days.

Can I renew my product if when it's expired?

Yes, when the 90 days of your product validity are over, you have the option of renewing your expired products with a 30% discount. This can be done in your Member's Area.

Please note that you will not be able to use the product after it has expired if you don't renew it.

How often are the questions updated?

We always try to provide the latest pool of questions, Updates in the questions depend on the changes in actual pool of questions by different vendors. As soon as we know about the change in the exam question pool we try our best to update the products as fast as possible.

How many computers I can download Pass4sure software on?

You can download the Pass4sure products on the maximum number of 2 (two) computers or devices. If you need to use the software on more than two machines, you can purchase this option separately. Please email sales@pass4sure.com if you need to use more than 5 (five) computers.

What are the system requirements?

Minimum System Requirements:

- Windows XP or newer operating system

- Java Version 8 or newer

- 1+ GHz processor

- 1 GB Ram

- 50 MB available hard disk typically (products may vary)

What operating systems are supported by your Testing Engine software?

Our testing engine is supported by Windows. Andriod and IOS software is currently under development.

Complete Guide to the CFE - Financial Transactions and Fraud Schemes Exam

In contemporary professional arenas, where competition is both relentless and ubiquitous, mere ambition no longer suffices to carve a distinguished trajectory. Employers increasingly prioritize verifiable expertise, and certification has emerged as a decisive mechanism to showcase mastery. Among these professional accolades, the Certified Fraud Examiner credential holds particular gravitas for aspirants aiming to excel in detecting, investigating, and preempting fraudulent financial activity. Unlike conventional academic degrees, which often demand protracted investment of both temporal and fiscal resources, certification offers a more direct, pragmatic, and efficient conduit to career elevation.

Pursuing this credential transcends the superficial acquisition of a title. It communicates to potential employers an assurance of both theoretical understanding and operational proficiency in unraveling complex fraudulent schemes. From banking institutions and corporate finance to forensic accounting and governmental oversight, possessing this certification signifies adeptness in sophisticated analytical techniques, investigative methodologies, and the subtle discernment required in modern fraud scenarios. It is a testament to both intellectual acuity and applied competence in a domain where precision is paramount.

The journey toward this level of expertise is anything but perfunctory. The Certified Fraud Examiner examination is meticulously designed to probe candidates across multiple dimensions of financial deception, demanding an integration of comprehensive knowledge and tactical problem-solving. Success is predicated not on rote memorization but on a nuanced understanding of intricate financial transactions, recognition of behavioral and transactional anomalies indicative of malfeasance, and the application of investigative strategies in both simulated and authentic contexts. Hence, meticulous preparation is indispensable, and the methodology adopted can markedly influence outcomes.

An increasingly efficacious resource for aspirants is . Conventional preparatory tools often fall short, creating a chasm between theoretical familiarity and practical readiness, leaving candidates vulnerable to anxiety and unpreparedness on examination day. , in contrast, adopts an immersive approach, curating exam simulations that replicate both the structure and cognitive demands of the Certified Fraud Examiner assessment. By engaging with these meticulously constructed exercises, candidates cultivate confidence, analytical dexterity, and practical insight, ensuring alignment between exam performance and professional competency.

A distinctive advantage of lies in its adaptability and contemporaneity. Financial fraud methodologies evolve with dizzying rapidity, and static study guides risk obsolescence, potentially leaving learners ill-equipped to navigate contemporary challenges. counters this by dynamically updating content, reflecting emergent regulatory frameworks, contemporary investigative tactics, and evolving fraud patterns. This iterative refinement ensures that candidates engage with material that is both current and contextually resonant, bridging the gap between theoretical instruction and the exigencies of real-world application.

Equally crucial is the structural sophistication embedded within the learning experience. Mastery of the Certified Fraud Examiner examination necessitates not only factual comprehension but strategic cognitive engagement. emphasizes active learning through extensive question banks and scenario-based exercises, fostering critical thinking, deductive reasoning, and nuanced problem-solving. This immersive methodology transcends passive absorption, compelling learners to internalize complex concepts through iterative practice, thereby solidifying both knowledge and adaptive analytical skill.

Moreover, acknowledges the heterogeneity of learning preferences. Its platform accommodates a spectrum of study modalities, offering free access to foundational resources alongside premium packages that provide comprehensive test simulations, printable question compendiums, and navigational enhancements. This customizable approach enables candidates to orchestrate their preparation according to personal pace, cognitive proclivities, and professional obligations, thereby optimizing retention and comprehension.

The credibility of ’s content creators constitutes another distinguishing attribute. Each preparatory module is curated by professionals with substantial field experience in fraud examination, ensuring that guidance is both practical and authoritative. These contributors illuminate the intricate mechanics of financial deception—from subtle ledger manipulations to sophisticated asset misappropriation—providing candidates with invaluable insights into investigative processes and forensic reasoning. Such expert-informed resources foster a robust understanding that extends beyond textbook knowledge into the practical exigencies of professional practice.

Preparation for this certification also entails psychological fortification. High-stakes examinations often induce anxiety, particularly when candidates are tasked with navigating convoluted financial data and intricate investigative scenarios. mitigates these stressors through immersive simulations, progress tracking, and targeted practice. By cultivating familiarity with examination conditions and reinforcing mastery over core concepts, learners develop confidence and composure—psychological assets that are as critical as analytical skill in achieving exam success.

Accessibility represents a further cornerstone of effective preparation. Many professionals must balance intensive careers, familial responsibilities, and ongoing personal development, necessitating flexible learning solutions. addresses this with mobile-optimized platforms, intuitive interfaces, and adaptable study schedules, permitting candidates to integrate preparation seamlessly into diverse routines. Whether during commutes, lunch intervals, or remote locations, learners can engage deeply with content without compromising quality or consistency, enhancing both efficiency and retention.

Customer support complements this framework, providing responsive assistance for technical or content-related queries. Prompt, knowledgeable guidance ensures that minor obstacles do not escalate into barriers to progress, sustaining momentum and maintaining focus on mastery. This attentive support underscores a commitment to holistic candidate development, extending beyond exam preparation to encompass overall learner satisfaction and professional growth.

The intellectual rigor demanded by the Certified Fraud Examiner credential fosters profound professional transformation. Candidates develop not only analytical acumen but also strategic discernment, ethical awareness, and investigative agility—competencies indispensable for navigating the labyrinthine complexities of financial fraud. This certification signals to employers a rare synthesis of knowledge, skill, and judgment, positioning credential holders as indispensable assets within their organizations and elevating career trajectories in a highly competitive landscape.

Preparation strategies that maximize success often integrate both conceptual mastery and practical application. Engaging with scenario-driven exercises, reflective case studies, and iterative testing cultivates an integrative understanding, ensuring that candidates can transition seamlessly from theoretical comprehension to operational execution. This approach mirrors the real-world demands of fraud examination, where analytical insight, investigative creativity, and procedural acumen converge in high-stakes contexts.

Another dimension of strategic preparation involves cultivating pattern recognition and forensic intuition. Financial fraud frequently manifests through subtle irregularities, requiring investigators to discern anomalies that may elude cursory scrutiny. Through repetitive engagement with complex problem sets and simulated investigations, candidates refine their perceptual acuity and develop heuristics that facilitate rapid identification of suspicious activity. This iterative skill-building is indispensable for both examination success and professional efficacy.

Ethical reasoning constitutes a further pillar of Certified Fraud Examiner mastery. Beyond technical competence, professionals must navigate nuanced moral landscapes, balancing investigative imperatives with legal constraints and organizational accountability. Preparation platforms that integrate ethical dilemmas, regulatory considerations, and decision-making frameworks enable candidates to internalize principled practices, fostering judgment that aligns with both legal mandates and professional standards.

Time management and cognitive endurance are equally essential. Examination scenarios frequently involve extensive data analysis, layered problem-solving, and decision-making under temporal constraints. Training regimens that simulate these conditions enable candidates to build stamina, prioritize effectively, and deploy analytical frameworks efficiently. This deliberate conditioning mirrors the high-pressure realities of professional fraud investigation, ensuring readiness for both examination and occupational demands.

Technological literacy also assumes growing significance. Modern fraud schemes often exploit digital platforms, complex databases, and algorithmic manipulations. Comprehensive preparation encompasses familiarity with digital forensic tools, data analysis software, and emerging technological modalities, equipping candidates with competencies requisite for contemporary investigative practice. Exposure to these digital instruments during preparation enhances analytical precision and operational versatility.

Interdisciplinary integration further amplifies the value of preparation. Certified Fraud Examiner candidates often draw upon principles from accounting, law, psychology, and information systems, synthesizing insights to construct holistic investigative frameworks. Platforms that facilitate cross-disciplinary engagement cultivate versatile problem-solving approaches, enabling candidates to navigate multifaceted fraud schemes with both breadth and depth of understanding.

Networking and community engagement enhance the preparatory journey. Interaction with peers, mentors, and experienced practitioners fosters knowledge exchange, collaborative problem-solving, and insight into evolving industry practices. Participatory forums, discussion groups, and mentorship opportunities enable candidates to contextualize theoretical knowledge, explore practical applications, and internalize lessons from real-world experiences, enriching both preparation and professional development.

Reflective practice is another underappreciated dimension of preparation. Reviewing completed exercises, analyzing errors, and conceptualizing alternative strategies cultivates metacognitive awareness, enhancing both retention and adaptability. By systematically reflecting on performance, candidates develop self-directed learning strategies, refine analytical frameworks, and cultivate resilience—qualities that extend well beyond the examination environment into sustained professional efficacy.

Finally, the culmination of preparation is not merely credential acquisition but transformative professional identity. Certified Fraud Examiner candidates emerge equipped with analytical rigor, investigative agility, ethical grounding, and strategic insight. The certification functions as both a formal testament to competence and a catalyst for ongoing professional evolution, signaling readiness to navigate increasingly sophisticated financial landscapes and complex organizational contexts.

In essence, achieving Certified Fraud Examiner distinction represents an integration of knowledge, skill, and strategic preparation. It necessitates deliberate engagement with sophisticated study resources, practical scenario simulation, ethical reasoning, technological proficiency, and reflective analysis. Platforms like provide a dynamic, adaptable, and meticulously curated framework that supports this multifaceted journey, enabling candidates to cultivate both cognitive mastery and professional confidence. Through rigorous preparation, learners not only attain certification but also emerge as highly capable practitioners, poised to contribute meaningfully to the field of fraud investigation and to advance within a competitive, evolving professional domain.

Mastering Financial Transactions and Fraud Schemes for Exam Excellence

Navigating the labyrinthine corridors of financial transactions demands an intricate understanding of both procedural nuance and psychological subtlety. The domain of financial fraud is seldom overt; it is frequently a protean phenomenon, shifting form across corporate strata, jurisdictional boundaries, and technological frameworks. Certified Fraud Examiners, therefore, must cultivate an acuity that extends beyond textbook knowledge into a realm of analytical prescience. The exam serves as a crucible, testing not merely recall but the capacity for discerning latent irregularities in complex financial matrices.

The preparatory journey begins with an exploration of transactional architecture. Legitimate financial processes often involve multilayered documentation, hierarchical approvals, and the interlacing of fiduciary responsibilities. Such structural intricacies, while vital for operational integrity, can simultaneously be exploited by those intent on subversion. Schemes range from subtle misrepresentations of financial statements to elaborate collusions involving multiple entities. Asset misappropriation, bribery, and conflict-of-interest manipulations are recurring motifs, yet their manifestations are often shrouded in procedural normalcy. An adept candidate must not merely recognize these manifestations but appreciate the nuanced divergence between legitimate operations and illicit circumvention.

In the pursuit of exam excellence, the adoption of sophisticated study mechanisms is imperative. Interactive platforms that simulate realistic scenarios foster a cognitive alignment with professional expectations. Instead of rote memorization, learners engage in scenario-based deduction, identifying red flags, hypothesizing investigative strategies, and testing the robustness of conclusions against dynamically presented evidence. This methodical engagement nurtures a mindset capable of navigating ambiguity while maintaining analytical rigor, ensuring that theoretical knowledge is transmuted into practical expertise.

A core principle in fraud detection is the synthesis of disparate data points into coherent analytical narratives. Malfeasance often resides in marginal anomalies, buried within quotidian transactions or subtle ledger inconsistencies. The exam rigorously evaluates a candidate’s aptitude in recognizing these anomalies, applying accounting acumen, and integrating regulatory frameworks into investigative reasoning. Proficiency extends beyond accounting literacy, requiring an epistemological dexterity to evaluate contradictory information, anticipate obfuscatory tactics, and render sound conclusions under scrutiny. Scenario-driven practice is instrumental in refining this composite skill set, reinforcing both cognitive agility and investigative precision.

The operational comprehension of investigative procedures constitutes another pivotal dimension. Fraud is rarely monolithic; it manifests as a concatenation of actions designed to conceal, manipulate, or obfuscate. Investigators must anticipate multi-faceted stratagems, ranging from falsified documentation to digital tampering. Exam preparation necessitates familiarity with forensic methodologies, evidence preservation, and the systemic interpretation of financial anomalies. By iterating through meticulously designed scenarios, candidates internalize procedural rigor, cultivate judgment under pressure, and develop resilience against cognitive biases that might compromise analytical objectivity.

Strategic study habits underpin effective mastery. Attempting to assimilate voluminous information without structure invites cognitive fatigue and superficial comprehension. Layered learning paths, commencing with foundational principles and progressing to intricate scenario analysis, optimize retention while mitigating mental overload. Incremental challenges foster confidence and engender a sustained momentum, enabling learners to approach complex analytical tasks with both competence and composure.

Quantitative measurement of progress is a hallmark of efficacious preparation. Practice assessments provide diagnostic insights, revealing areas of proficiency and deficiency. This granularity allows learners to allocate cognitive resources with precision, enhancing study efficiency and reinforcing confidence. Progress tracking is not merely motivational; it cultivates metacognitive awareness, enabling candidates to refine strategies, anticipate exam contingencies, and internalize adaptive problem-solving heuristics.

Ethical and regulatory literacy is an indispensable facet of professional preparedness. Fraud examination operates at the intersection of law, corporate governance, and moral accountability. Candidates must demonstrate fidelity to ethical standards even when confronted with ambiguous or high-stakes scenarios. By incorporating case studies, ethical dilemmas, and compliance considerations into preparation, learners internalize principles of professional integrity, cultivating judgment that is both legally informed and ethically grounded. This integration of technical expertise and ethical discernment is essential for sustaining credibility in both exam contexts and professional practice.

Flexibility and accessibility further amplify learning efficacy. The demands of professional life necessitate adaptive study modalities, allowing engagement during commutes, brief interludes, or mobile-accessible sessions. By facilitating seamless integration of preparation into daily routines, learners maintain consistency, deepen comprehension, and reinforce cognitive associations through frequent exposure. This adaptability is especially vital for complex material, where repetition and contextual reinforcement are critical for mastery.

Support systems and user experience significantly influence the trajectory of exam readiness. Even the most meticulously designed study tools can falter without prompt, knowledgeable assistance when challenges arise. Reliable guidance ensures continuity, enabling learners to navigate technical or conceptual obstacles without compromising momentum. Such comprehensive support fosters a sense of assurance and empowerment, augmenting both competence and confidence in approaching high-stakes assessments.

The long-term dividends of mastering financial transactions and fraud schemes extend far beyond examination success. Certified professionals acquire not only enhanced employability but also a capacity to effectuate tangible organizational integrity. Career trajectories may traverse auditing, forensic accounting, corporate investigation, or regulatory enforcement. Beyond occupational advancement, this expertise equips professionals to anticipate risk, safeguard assets, and deter malfeasance, cultivating environments of trust and accountability.

Developing an investigative mindset involves cultivating both analytical discernment and intuitive insight. Fraud is often cloaked in procedural normalcy, and the examiner’s challenge lies in perceiving the subtle divergences that betray deception. This requires proficiency in forensic accounting, familiarity with technological audit tools, and an appreciation for behavioral cues that may indicate collusion or misrepresentation. Candidates trained in this multifaceted approach develop the agility to pivot strategies as evidence emerges, a skill critical to both examination scenarios and professional practice.

Scenario simulation serves as a cognitive crucible, exposing learners to probabilistic reasoning, deductive analysis, and ethical quandaries simultaneously. Each exercise cultivates a nuanced understanding of risk, consequence, and investigative methodology. By repeatedly confronting complex, ambiguous problems, candidates internalize patterns of thought that elevate decision-making quality, fostering intellectual resilience and adaptive expertise.

Cognitive integration is further enhanced by synthesizing theory with practical application. Concepts such as asset misappropriation, corruption, and financial misstatement must be contextualized within procedural, ethical, and regulatory frameworks. Exam preparation that emphasizes contextual learning transforms isolated facts into actionable knowledge, equipping candidates to evaluate evidence holistically, anticipate fraudulent behaviors, and implement corrective measures effectively.

Technology and data analytics play an increasingly prominent role in both examination preparation and professional practice. Digital tools enable simulation of large datasets, detection of anomalies, and assessment of procedural efficiency. Candidates adept at leveraging these resources acquire not only exam readiness but also operational competence, reinforcing analytical acuity and procedural fluency in environments where digital records dominate investigative processes.

Meticulous documentation of investigative findings constitutes another crucial competency. Accurate, comprehensive, and auditable records ensure that conclusions are defensible, replicable, and transparent. Preparation exercises that emphasize documentation protocols foster discipline, clarity, and precision, preparing candidates for professional expectations where credibility and accountability are paramount.

Exam mastery is inseparable from confidence cultivated through structured repetition. Incremental exposure to increasingly complex scenarios reinforces both competence and composure. Learners develop an internalized framework for decision-making, allowing them to navigate the cognitive pressures of timed assessments without sacrificing analytical depth or procedural rigor.

The strategic allocation of study effort, informed by diagnostic feedback, enhances efficiency and efficacy. By targeting deficiencies with precision, learners avoid redundant effort while reinforcing areas of relative weakness. This optimization fosters not only preparedness but also resilience, allowing candidates to approach the exam with a sense of strategic control and intellectual mastery.

Ethical discernment remains a constant undercurrent throughout preparation and practice. Fraud examination transcends mere detection; it embodies principled intervention, ensuring that findings are addressed in accordance with law, professional standards, and organizational policy. By confronting ethical dilemmas during preparation, learners cultivate judgment that is both principled and pragmatic, equipping them to navigate real-world ambiguities with integrity.

Professional versatility emerges naturally from mastery of financial transactions and fraud schemes. Certified practitioners command respect across auditing, corporate governance, law enforcement, and investigative domains. Their expertise positions them to identify systemic vulnerabilities, implement preventive controls, and contribute meaningfully to organizational accountability. The certification is, therefore, not merely a credential but a conduit for professional influence, credibility, and societal contribution.

The iterative cycle of practice, feedback, and refinement underpins sustainable mastery. By engaging with progressively sophisticated scenarios, analyzing outcomes, and adjusting strategies, candidates internalize principles of adaptive expertise. This continuous refinement mirrors the professional environment, where evolving risks, regulatory changes, and technological advancements demand perpetual learning and cognitive agility.

In summation, mastering the domain of financial transactions and fraud schemes necessitates a confluence of analytical rigor, procedural acumen, ethical discernment, and strategic preparation. Exam readiness is cultivated not through passive memorization but through active engagement with scenario-based problem solving, investigative simulation, and reflective practice. Digital tools and structured study pathways provide a scaffold for this engagement, enabling candidates to internalize competencies, track progress, and refine judgment.

Certification transcends the immediate objective of examination success. It embodies the cultivation of expertise, the enhancement of professional credibility, and the empowerment to influence organizational integrity. Mastery of these competencies equips professionals to confront financial malfeasance with confidence, precision, and ethical clarity, contributing to resilient, accountable, and transparent systems.

The pursuit of excellence in this domain is therefore both a professional imperative and a personal endeavor. Candidates who embrace rigorous preparation, iterative learning, and principled analysis develop not only exam proficiency but also enduring professional capability. Their expertise safeguards assets, fortifies trust, and ensures that financial ecosystems operate with integrity, transparency, and resilience, reflecting the highest ideals of the Certified Fraud Examiner profession.

The Intricacies of Attaining the Certified Fraud Examiner Credential

Achieving the Certified Fraud Examiner credential necessitates a meticulous orchestration of intellectual rigor and practical acumen. Beyond rote memorization, it demands a symphony of analytical prowess, investigative dexterity, and strategic cognition. Candidates embarking on this journey must reconcile the abstract with the concrete, synthesizing theoretical constructs with real-world application. Preparation is seldom linear; it is an iterative process that oscillates between conceptual comprehension and experiential assimilation, cultivating a mindset attuned to both detail and overarching patterns.

Deconstructing Financial Transactions and Fraud Schemes

Fraudulent activities in financial realms are labyrinthine, characterized by interwoven mechanisms of deception. From asset misappropriation to financial statement manipulation, corruption, and bribery, each domain exhibits its own idiosyncratic challenges. Understanding these complexities transcends surface-level engagement, requiring an appreciation for subtle anomalies, procedural deviations, and behavioral foreshadowing. Candidates must cultivate an investigative lens capable of discerning obfuscation in accounting entries, irregularities in transaction flows, and latent signals of malfeasance that may evade cursory inspection.

Layered Learning for Comprehensive Mastery

A layered approach to preparation fortifies both retention and analytical depth. Foundational concepts should be internalized first, establishing a bedrock upon which intricate cases can be examined. Progressing to detailed case studies illuminates the multifaceted nature of fraudulent schemes, enabling learners to contextualize theoretical constructs within operational realities. Subsequent engagement with scenario-based problem-solving simulates examination conditions, sharpening cognitive agility and reinforcing procedural fluency. This sequential methodology ensures that candidates are not only knowledgeable but strategically adept in deploying that knowledge under scrutiny.

Simulation of Real-World Questions for Practical Insight

Immersive practice through meticulously curated questions enhances both familiarity and intuition. By confronting scenarios that mirror real-life occurrences, candidates develop a perceptive understanding of misrepresentation, subtle manipulations, and behavioral aberrations. This experiential rehearsal cultivates pattern recognition and fortifies judgment under ambiguity. Recognizing the faintest discrepancies in ledger entries or interpreting the nuance behind executive behaviors can distinguish competent practitioners from exemplary fraud examiners, highlighting the value of realistic, application-oriented preparation.

Constructing a Personalized Study Plan

Strategic organization of preparation is paramount. Candidates benefit from structuring study schedules that integrate theoretical review, multiple-choice exercises, and case analysis. Deliberate pacing, combined with spaced repetition, facilitates long-term retention and cognitive consolidation. Revisiting challenging topics intermittently, rather than in a monolithic session, nurtures familiarity with complex principles and mitigates cognitive fatigue. A tailored approach accommodates individual learning rhythms, optimizing comprehension and reinforcing procedural fluency.

Cultivating the Investigative Mindset

Beyond factual knowledge, the Certified Fraud Examiner credential emphasizes investigative acumen. Candidates are expected to discern incongruities, interpret contextual signals, and connect disparate data points into coherent conclusions. Developing this analytical acuity requires consistent engagement with multifaceted scenarios, demanding both deductive reasoning and inferential synthesis. Practicing multi-step cases hones the ability to evaluate risk, predict behavioral tendencies, and formulate actionable solutions, bridging theoretical understanding with operational effectiveness.

Time Management as a Critical Success Vector

The temporal rigor of the Certified Fraud Examiner examination necessitates precise time allocation and decision-making efficiency. Candidates must navigate complex questions within strict time constraints, balancing speed with analytical accuracy. Practicing under simulated temporal pressures develops resilience and cognitive agility, allowing candidates to approach the actual exam with strategic pacing. Mastery of time management ensures that analytical depth is not sacrificed to haste, fostering both confidence and methodical precision under duress.

Ethical Discernment and Professional Integrity

Ethics underpin the practice of fraud examination, permeating every dimension of the credentialing process. Candidates encounter hypothetical scenarios that probe moral judgment, requiring decisions that reconcile legal imperatives with ethical imperatives. Engaging with these dilemmas during preparation cultivates principled reasoning, reinforcing the alignment between professional conduct and regulatory expectations. Ethical fluency ensures that candidates are equipped not only to detect fraud but also to navigate complex moral landscapes with integrity and prudence.

Technological Integration in Study Routines

The digitization of study materials has transformed preparatory paradigms. Mobile-compatible platforms allow candidates to utilize previously unproductive intervals for learning, ensuring continuous engagement with content. Interactive modules provide instantaneous feedback, elucidating knowledge gaps and guiding targeted review. Technological integration enhances adaptability, allowing learners to simulate examination conditions, practice diverse question formats, and refine strategies in response to evolving scenarios. This fusion of accessibility and interactivity elevates preparation from passive consumption to dynamic engagement.

The Role of Cognitive Resilience and Motivation

Sustained preparation demands unwavering cognitive resilience and motivational consistency. Certification is a longitudinal endeavor, requiring persistent engagement, incremental achievement, and adaptive problem-solving. Establishing milestones, monitoring progress, and celebrating incremental victories fortify motivation and reinforce the cumulative value of each study session. Embracing a growth mindset, whereby challenges are reframed as opportunities for skill augmentation, fosters perseverance and enhances long-term professional competence.

Analytical Techniques for Fraud Detection

Proficiency in fraud examination is predicated upon nuanced analytical capabilities. Candidates must discern patterns, evaluate probabilistic scenarios, and identify anomalies within voluminous datasets. Techniques such as variance analysis, trend evaluation, and comparative benchmarking facilitate the identification of discrepancies, while qualitative evaluation of behavioral indicators complements quantitative methods. Mastery of these analytical tools underpins the capacity to construct coherent investigative narratives and develop evidence-based conclusions with precision.

Scenario-Based Problem Solving for Exam Readiness

Scenario-based exercises are instrumental in bridging theoretical knowledge with pragmatic application. By simulating complex, multi-variable situations, candidates refine cognitive flexibility, adapt to emergent ambiguities, and reinforce procedural rigor. Each scenario demands a synthesis of analytical skills, ethical judgment, and investigative reasoning, mirroring the challenges encountered in actual professional practice. Repeated exposure to such exercises enhances strategic foresight and prepares candidates for high-stakes decision-making.

Behavioral Red Flags in Corruption and Bribery

Identifying behavioral cues is integral to the investigative process. Fraudulent conduct often manifests through subtle behavioral deviations, including inconsistent reporting, reluctance to disclose information, or patterns of undue influence. Candidates must develop observational acuity, linking behavioral signals to contextual evidence and underlying transactional anomalies. Understanding the interplay between human behavior and financial irregularities is essential for constructing comprehensive investigative frameworks and strengthening fraud detection efficacy.

Integrating Case Studies into Mastery

Case studies offer a prism through which theoretical knowledge can be applied and interrogated. By dissecting historical or hypothetical scenarios, candidates gain insight into the multifaceted dynamics of fraud schemes. This process facilitates critical thinking, reinforces pattern recognition, and elucidates procedural subtleties that may be obscured in abstract study. Integration of case study analysis into preparation enhances both cognitive depth and practical competence, fostering a holistic understanding of complex financial malfeasance.

Spaced Repetition and Cognitive Consolidation

Effective retention is predicated upon deliberate repetition. Spaced repetition allows for iterative reinforcement of challenging concepts, preventing cognitive decay and fostering long-term assimilation. By strategically revisiting topics, candidates cultivate a layered understanding, linking foundational knowledge with advanced application. This methodology optimizes memory retention, reinforces analytical reasoning, and ensures preparedness for nuanced examination questions that probe depth as well as breadth.

Leveraging Feedback for Continuous Improvement

Immediate and precise feedback is instrumental in refining understanding and correcting misconceptions. Practice exercises and simulations provide diagnostic insights, revealing gaps in knowledge and areas of procedural weakness. Candidates who actively engage with feedback loops develop metacognitive awareness, adjust strategies proactively, and consolidate strengths while addressing deficiencies. This continuous refinement elevates overall preparedness, ensuring that examination readiness is both thorough and adaptive.

The Intersection of Regulatory Knowledge and Practical Investigation

A Certified Fraud Examiner must operate at the confluence of regulatory comprehension and operational efficacy. Understanding statutes, compliance frameworks, and reporting obligations is essential for accurate assessment of fraud scenarios. Equally important is the ability to translate this knowledge into actionable investigative procedures, ensuring adherence to legal standards while executing effective detection and remediation strategies. Mastery of this intersection cultivates professional competence and reinforces ethical practice.

Strategic Allocation of Study Resources

Resource management is a critical determinant of preparation success. Candidates must allocate time, cognitive effort, and materials judiciously, balancing review of theoretical content with intensive practice sessions. Prioritization of high-impact topics, integration of diverse learning modalities, and iterative reassessment of progress enable efficient use of resources. Strategic allocation maximizes return on investment, ensuring that preparation is both effective and sustainable across the preparatory timeline.

Advanced Pattern Recognition Techniques

Sophisticated fraud detection relies on advanced pattern recognition. Beyond superficial analysis, candidates must identify recurring anomalies, subtle manipulations, and latent trends indicative of systemic malfeasance. Techniques such as network analysis, forensic accounting heuristics, and predictive modeling enhance the ability to anticipate fraudulent behaviors and construct proactive investigative strategies. This elevated analytical capacity distinguishes exemplary practitioners from those with only cursory proficiency.

The Synergy of Ethical Vigilance and Investigative Insight

Ethical vigilance is inextricably linked to investigative insight. A principled approach to fraud examination ensures that analyses are conducted with integrity, conclusions are defensible, and recommendations align with regulatory and moral standards. Candidates who internalize ethical considerations integrate them seamlessly into investigative reasoning, enhancing both credibility and efficacy. This synergy between ethics and insight fortifies professional judgment and prepares candidates for real-world complexities.

Building Enduring Professional Competencies

Preparation for the Certified Fraud Examiner credential extends beyond exam success; it cultivates enduring competencies. Candidates acquire analytical rigor, ethical discernment, investigative proficiency, and strategic problem-solving skills applicable throughout their professional trajectory. The knowledge and capabilities developed during preparation constitute a foundation for sustained career advancement, enabling practitioners to navigate increasingly complex financial landscapes with expertise and confidence.

Sustaining Motivation Through Long-Term Preparation

Maintaining engagement throughout the preparatory journey requires intentional motivational strategies. Candidates benefit from goal-setting, reflective practice, and recognition of incremental progress. By framing challenges as opportunities for growth and acknowledging each achievement, learners sustain momentum, cultivate resilience, and reinforce commitment. This psychological scaffolding underpins consistent effort, ensuring that preparation remains purposeful, structured, and ultimately rewarding.

Strategic Mastery for Certified Fraud Examiners

In sum, attaining the Certified Fraud Examiner credential demands a multidimensional strategy that integrates cognitive rigor, investigative acumen, ethical discernment, and technological utilization. Layered learning, scenario-based practice, effective time management, and continuous engagement with feedback collectively enhance examination readiness. Candidates who adopt a strategic, disciplined, and reflective approach not only optimize their likelihood of success but also cultivate professional capabilities that endure long beyond the credential itself, establishing a foundation for leadership in fraud examination and financial forensics.

Exam-Day Excellence and Psychological Readiness

Success in the Certified Fraud Examiner exam is a confluence of meticulous preparation and refined psychological fortitude. The culmination of months, often years, of intellectual rigor converges on a single day, where composure, analytical acuity, and strategic thinking dictate outcomes. Beyond rote knowledge, the psyche must be cultivated to withstand pressure, maintain clarity, and apply investigative principles with precision.

Familiarity with the exam’s architecture is indispensable. The exam probes a spectrum of competencies, encompassing financial scrutiny, forensic investigation, and fraud pattern recognition. Candidates who have internalized the structural nuances of questions, timing sequences, and scenario complexities enter the testing environment with an inherent advantage. Simulated exams that replicate the cadence, time restrictions, and cognitive demands cultivate familiarity, transforming apprehension into strategic assurance.

Time orchestration is paramount. Many candidates falter under the compulsion to accelerate through sections, sacrificing meticulousness for speed. Developing an internalized pacing rhythm during preparatory phases ensures judicious allocation of cognitive resources. Timed mock examinations not only reveal the velocity of problem-solving under duress but also illuminate sections that necessitate heightened focus, enabling candidates to adjust strategies for a uniform and sustainable performance trajectory.

Physical and cognitive optimization is equally vital. Mental acuity is inseparable from corporeal equilibrium. Adequate sleep cycles, nutrient-rich sustenance, and deliberate stress mitigation form the substratum of high-caliber exam performance. Techniques such as mindfulness meditation, diaphragmatic breathing, and concise pre-exam rituals engender serenity, allowing analytical faculties to operate at maximal efficiency. Candidates deprived of these preparatory rituals risk diminished cognitive responsiveness despite extensive subject mastery.

Strategic prioritization during the exam elevates performance. Recognizing that not all queries exert equivalent cognitive load enables candidates to triage effectively. Initial cursory scanning allows confident questions to be addressed first, reserving intricate or convoluted scenarios for later engagement. This methodology conserves mental capital, reduces decision fatigue, and optimizes overall score potential by leveraging strengths cultivated during preparation.

Meticulous attention to granular detail is non-negotiable. Financial forensic examinations often hinge upon minute distinctions in transactional data, terminological specificity, or pattern recognition. Methodical interrogation of each question, coupled with cross-referencing of information, mitigates error incidence. Extensive rehearsal with authentic scenarios equips candidates to detect subtleties and respond with precision under temporal constraints, distinguishing proficient candidates from their less-prepared counterparts.

Emotional resilience acts as an unseen differentiator. Encounters with unanticipated complexities or challenging scenarios can provoke stress-induced cognitive impairment. Top performers harness composure to navigate adversity logically, employing adaptive strategies rather than succumbing to instinctive panic. Iterative exposure to high-difficulty scenarios during preparation cultivates this resilience, reinforcing confidence and instilling an appreciation that complex challenges are surmountable with systematic application of learned methodologies.

Examination strategies, such as the process-of-elimination or informed conjecture, serve as cognitive scaffolds. Uncertainty is an intrinsic component of high-stakes testing, yet structured methodologies enable candidates to navigate ambiguity with calculated precision. Regular practice of these strategies during preparatory phases ensures fluid application under exam conditions, offering a cognitive safety net that preserves accuracy without compromising overall strategic execution.

Post-examination analysis represents a pivotal, albeit frequently neglected, dimension of sustained success. Regardless of immediate outcomes, reflective evaluation allows candidates to dissect performance, identify latent weaknesses, and codify actionable insights for ongoing professional development. Continuous reflection fosters a growth-oriented mindset, underscoring the principle that mastery extends beyond certification and permeates long-term career competence.

In summation, achievement in the Certified Fraud Examiner exam emerges from the synergistic interplay of rigorous intellectual preparation, disciplined time management, cognitive optimization, and psychological fortitude. Candidates who harmonize methodical study with practical rehearsal, ethical cognizance, emotional resilience, and strategic reasoning approach the exam with heightened confidence, clarity, and adaptability. This integrated approach not only facilitates success on the exam but also cultivates enduring professional acumen, preparing candidates to navigate the intricate and evolving landscape of fraud examination with poise, discernment, and authoritative competence.

Leveraging Certification for Career Growth and Professional Influence

Achieving the Certified Fraud Examiner credential transcends mere professional recognition; it embodies a paradigm shift in one’s vocational trajectory. This credential is not merely a testament to technical aptitude in detecting financial duplicity but a veritable emblem of ethical discernment and investigative acumen. By strategically leveraging such certification, professionals can cultivate influence, command authority, and navigate the labyrinthine corridors of corporate and governmental enterprises with heightened efficacy.

The immediate advantage of attaining certification manifests in enhanced professional credibility. Organizations and executive leadership recognize the rigorous and exacting standards inherent in the Certified Fraud Examiner examination. Credentialed individuals are often perceived as paragons of trustworthiness and investigative competence, capable of dissecting intricate financial malfeasance with precision. Such recognition can catalyze promotions, engender elevated remuneration, and unlock opportunities to helm complex audits, forensic inquiries, and compliance initiatives. Individuals who amalgamate technical proficiency with moral rectitude invariably ascend into leadership roles across diverse sectors such as forensic accounting, corporate compliance, and law enforcement.

Equally salient is the competitive edge that certification confers in the contemporary professional milieu. In a saturated marketplace where technical skills are ubiquitous, the discernment to apply knowledge judiciously and ethically distinguishes the accomplished professional. Employers increasingly prioritize demonstrable expertise over mere credentials. The Certified Fraud Examiner designation functions as a beacon of specialized competence, signaling to potential employers that the professional is equipped not only to navigate but also to anticipate and mitigate fraudulent activity. Such differentiation enhances employability, elevates career trajectories, and cultivates enduring professional authority.

Professional versatility represents another profound benefit of certification. Certified Fraud Examiners possess skillsets that are remarkably transposable across diverse industries, including banking, healthcare, government regulatory agencies, and consultancy practices. The methodologies and analytical frameworks ingrained during certification training are universally applicable, enabling professionals to pivot seamlessly across organizational contexts. This malleability is particularly advantageous in volatile labor markets, where adaptability, resilience, and cross-disciplinary competence are increasingly valorized.

Networking opportunities arising from certification are frequently underestimated yet constitute a critical dimension of professional growth. By joining the global consortium of Certified Fraud Examiners, individuals gain access to a vibrant ecosystem of mentors, peers, and thought leaders. Engagement within this network facilitates collaborative knowledge exchange, exposure to emergent trends, and participation in strategic discourse regarding fraud prevention and investigative innovation. These interactions foster continuous intellectual stimulation, cultivate professional alliances, and amplify visibility within the industry. The intangible benefits of such networks—reputation enhancement, access to insider knowledge, and mentorship—can be as consequential as formal career advancements.

Sustained professional development remains an intrinsic component of leveraging certification effectively. Rather than serving as a terminus, certification constitutes a foundational platform upon which continuous learning and skill augmentation are constructed. Engaging in advanced certifications, targeted professional training, and immersive practical experiences ensures that competencies remain relevant, current, and actionable. Continuous development reinforces professional gravitas, cultivates authority in decision-making contexts, and signals unwavering commitment to ethical and technical excellence. Moreover, this dedication to growth positions the professional as a thought leader within their domain, capable of influencing organizational strategy and fostering systemic integrity.

The capacity to shape organizational culture and ethical frameworks is among the most consequential advantages of attaining certification. Armed with an intricate understanding of fraudulent schematics and preventive methodologies, Certified Fraud Examiners can counsel leadership on risk mitigation, enforce robust internal controls, and promulgate ethical practices across hierarchical structures. Their interventions extend beyond immediate operational concerns, engendering a pervasive culture of transparency, accountability, and fiduciary responsibility. Consequently, the professional exerts influence not merely over their career trajectory but over the very ethos of the institution they serve.

Beyond career advancement and organizational influence, the attainment of certification carries profound personal enrichment. The journey toward credentialing cultivates analytical dexterity, meticulous attention to detail, and strategic foresight. Professionals emerge from this rigorous process with enhanced cognitive frameworks capable of dissecting multifaceted financial anomalies, discerning subtle patterns of misconduct, and navigating complex legal and regulatory landscapes. Such capabilities engender confidence and autonomy, empowering the individual to make informed, ethically sound decisions in high-stakes environments.

Certification also functions as a catalyst for interdisciplinary integration. Fraud examination, by its very nature, necessitates comprehension of accounting principles, legal statutes, corporate governance norms, and behavioral psychology. Certified professionals synthesize knowledge across these domains, cultivating holistic perspectives that inform investigative strategies and organizational policy development. This interdisciplinary fluency enhances problem-solving capabilities, promotes innovation in fraud detection, and reinforces the professional’s indispensability within the organizational architecture.

Moreover, the influence of certification extends into the realm of industry-wide thought leadership. Certified Fraud Examiners are often called upon to contribute to policy formulation, white papers, research publications, and professional symposia. By disseminating insights gleaned from empirical investigations, they shape best practices, elevate sectoral standards, and contribute to the collective enhancement of ethical and investigative norms. This intellectual stewardship reinforces their professional stature and amplifies their impact far beyond immediate organizational boundaries.

The intrinsic value of certification is further magnified by its role in fostering resilience amidst ethical quandaries and operational ambiguity. Professionals armed with comprehensive knowledge of fraud schemes and investigative methodologies are better equipped to navigate moral dilemmas, detect covert manipulations, and maintain integrity under pressure. This moral and cognitive resilience ensures that Certified Fraud Examiners operate with efficacy and impartiality, fortifying both their personal credibility and the organizational frameworks within which they function.

Economic advantages accompanying certification are tangible and compelling. Research and anecdotal evidence suggest that Certified Fraud Examiners frequently command higher salaries than non-certified peers, reflecting both market recognition of their specialized skills and the premium placed on ethical and investigative reliability. Moreover, the credential can accelerate career trajectories by facilitating access to high-profile roles in forensic accounting, compliance management, and regulatory oversight. In effect, certification serves as both a professional differentiator and a conduit to financial and occupational security.

The psychological dimension of professional influence should not be underestimated. Certification instills a profound sense of purpose, equipping professionals with the confidence to assert authority in investigative, advisory, and executive capacities. This confidence is underpinned by rigorous preparation, ethical grounding, and mastery of complex analytical frameworks. In turn, such psychological empowerment enhances interpersonal effectiveness, negotiation acumen, and the ability to drive organizational change.

Professional influence derived from certification is also evidenced in mentorship and capacity-building roles. Certified practitioners are uniquely positioned to educate, guide, and inspire junior colleagues, fostering talent pipelines and nurturing ethical vigilance within organizations. This mentorship not only propagates best practices but also cultivates a culture of accountability and continuous improvement, amplifying the impact of certification across successive professional generations.

Certification is not static; its utility evolves with professional experience and emerging industry paradigms. As technological innovations, regulatory reforms, and sophisticated fraud schemes emerge, the Certified Fraud Examiner remains at the vanguard of knowledge and application. By engaging in ongoing education, practitioners ensure that their expertise adapts to contemporary challenges, thereby maintaining relevance, credibility, and influence in dynamic professional ecosystems.

The integrative impact of certification manifests most profoundly when professionals leverage their credentials to influence systemic reform. By advising organizational leadership, recommending policy enhancements, and implementing proactive investigative frameworks, Certified Fraud Examiners contribute to the mitigation of risk and the fortification of organizational resilience. This strategic influence positions them not merely as technical specialists but as architects of integrity, whose insights shape operational, cultural, and ethical trajectories.

Furthermore, certification engenders a profound commitment to lifelong learning and reflective practice. The iterative process of updating skills, reassessing methodologies, and integrating emerging knowledge fosters intellectual agility, professional maturity, and strategic foresight. Such attributes are invaluable in a profession characterized by evolving fraud typologies, complex regulatory environments, and the persistent need for ethical vigilance.

In summation, the Certified Fraud Examiner credential embodies far more than a professional accolade; it constitutes a transformative instrument of career evolution, ethical authority, and organizational influence. By judiciously leveraging this credential, professionals enhance credibility, differentiate themselves in competitive labor markets, and cultivate versatile, high-impact careers across diverse industries. The benefits of certification extend beyond personal advancement, encompassing network expansion, mentorship, thought leadership, and systemic contribution to organizational integrity.

The journey toward certification demands discipline, cognitive dexterity, and ethical acumen, yet its rewards—spanning professional recognition, career acceleration, and profound influence—are commensurate with the effort invested. Strategic engagement with the credential, complemented by continuous learning and applied practice, ensures that professionals remain at the forefront of investigative excellence, organizational stewardship, and sectoral innovation. Ultimately, certification is both a milestone and a catalyst, a testament to expertise, and a gateway to enduring professional growth, influence, and impact.

Conclusion

The Financial Transactions and Fraud Schemes section of the Certified Fraud Examiner (CFE) exam represents both a rigorous test of technical knowledge and a crucible for analytical acuity. Success in this domain is not merely a function of memorizing accounting standards or fraud typologies; it requires the integration of investigative insight, critical reasoning, and a disciplined approach to complex problem-solving. Candidates who achieve mastery understand that every financial anomaly, no matter how minor, may conceal deeper patterns of deception and that systematic examination is essential to uncovering fraud.

A key takeaway is the necessity of a methodical analytical framework. Financial documents, transactional flows, and organizational records are the raw materials from which fraud is detected. Candidates must develop the ability to deconstruct these elements, tracing irregularities and inconsistencies with precision. The capacity to link seemingly unrelated data points and identify patterns across multiple accounts distinguishes proficient exam-takers from those who struggle under time constraints. Repeated exposure to practice scenarios enhances familiarity with the types of financial manipulations commonly encountered, sharpening both speed and accuracy.

Equally important is a thorough understanding of diverse fraud schemes. From asset misappropriation to sophisticated financial statement fraud, each scheme presents unique indicators and investigative challenges. Candidates must not only recognize the schemes themselves but also comprehend the methods perpetrators use to obscure wrongdoing. This dual knowledge—of both execution and concealment—allows candidates to anticipate deceptive practices and apply forensic reasoning to unravel them. Awareness of emerging fraud trends and evolving technological enablers further enhances investigative effectiveness, ensuring that candidates are prepared for contemporary challenges in the field.

Time management and strategic prioritization play a pivotal role in translating knowledge into exam performance. Questions often demand multi-layered analysis, requiring candidates to discern relevant information, apply investigative logic, and reach accurate conclusions efficiently. Practicing under timed conditions cultivates an intuitive sense of pacing, enabling candidates to allocate attention to complex scenarios without sacrificing accuracy elsewhere. This skill, coupled with mental resilience, mitigates stress and supports sustained cognitive performance throughout the exam.

Attention to detail remains a constant thread. Fraud detection thrives on the ability to notice subtle anomalies—an unusual ledger entry, a misaligned timestamp, or a discrepancy in supporting documentation. Candidates who approach each question with disciplined scrutiny, cross-referencing evidence and verifying assumptions, significantly enhance their likelihood of success. Methodical precision combined with strategic insight creates a balance between careful analysis and efficient execution.

Ultimately, mastery of the Financial Transactions and Fraud Schemes section is a synthesis of preparation, practice, and psychological readiness. Candidates who cultivate technical proficiency, reinforce it through realistic practice scenarios, and develop the cognitive resilience to perform under pressure position themselves not only for exam success but for enduring professional competence. The knowledge and analytical skills honed through this preparation extend beyond certification, empowering CFEs to confront complex fraud challenges with authority, discernment, and confidence. The exam thus serves not only as a credentialing milestone but as a catalyst for professional growth and investigative excellence.